No Plan B for Saudi Energy Policy

Saudi Arabia is betting that oil markets will rebalance themselves at higher prices, and it has no economic backup plan if prices remain low.

The Saudi government has assumed the responsibility of rebalancing the global oil markets and pushing crude prices back up. Since November 30, when the Organization of the Petroleum Exporting Countries (OPEC) reached an agreement with non-OPEC producers—including Russia, Oman, and Mexico—to cut production, this strategy has yet to have any significant effect on global oil prices. Even worse for Saudi Arabia, the kingdom has no backup plan for its current energy policy if prices do not rise again and the agreement falters. The lack of a concrete and long-term energy policy could severely impact the expected sale of Aramco (the national oil producing company) shares later this year, as well as Saudi Arabia’s fiscal and social stability and regional geopolitical role.

For over twenty years, Minister of Petroleum and Mineral Resources Ali Al-Naimi’s policy was to play a passive role in global oil markets, having learned from Saudi Arabia’s failure to defend OPEC prices in the 1980s. But this policy was abandoned when Deputy Crown Prince Mohamed bin Salman gained more control over the country’s economic and oil policy in early 2016. Under Khaled al-Falih, who was appointed the new minister in May 2016, Saudi Arabia moved to encourage OPEC and non-OPEC players alike to reduce global oil production through a series of summits and meetings. Taking a leadership role and bearing the largest burden of production cuts, Saudi Arabia under al-Falih is largely betting that oil markets will rebalance themselves, with supply reducing to match demand and pushing prices to a new, higher equilibrium.

When oil prices declined in 2015, industry experts blamed Saudi Arabia for driving oil prices down, accusing it of flooding the international markets with excess crude production. U.S. shale producers firmly believed that Saudi Arabia was on a mission to kill the American shale oil and gas industry, which initially needed high oil prices to make exploration and development financially viable. Moscow believed Saudis were using depressed oil prices to pressure Russia for its participation in the Syrian war and support for the Al-Assad regime. Iranians perceived Saudi oil policy as a proxy war tactic against its ideological and geopolitical foe in the Middle East.

But in fact, Saudi Arabia was only playing a passive role and abiding by its long-stated policy of nonintervention in oil markets—it was a price taker like everyone else. The sheer surplus of oil on the markets was evident from the numbers. Amid stagnant global demand for oil, Russia maintained high production rates above 10 million barrels per day, while the United States was producing a record high of both crude oil and petroleum products, with barrels produced increasing an average of 13.3 percent per year between 2012 and 2015. Saudi Arabia had no grand policy or scheme in maintaining production during this surplus. Saudi Arabia did not cut production then because it did not want to risk being perceived as a market manipulator or controller. Al-Naimi’s job was to make the king look good internationally, and his oil policy was based on not being perceived as aggressive, hostile, and controlling in the oil markets.

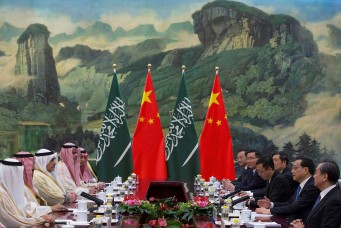

Unlike Al-Naimi, Al-Falih believes he can bring order to global oil markets and raise prices again. At global summits—such as the CERAWeek energy conference held March 6-10, 2017 or the World Economic Forum’s annual meeting in Davos held January 17-20, 2017—Al-Falih has been trying to convince most stakeholders in the energy markets that the Saudis have a solid energy policy guiding its leadership of the oil markets. His task is to ensure higher prices so Saudi Arabia can ease its economic pains, increase state revenues to fund regional geopolitical endeavors such as the Yemen war, and provide higher valuation for Aramco’s upcoming listing on global stock exchanges, which will provide funding for the government’s National Transformation Program 2020, a part of the Vision 2030 economic reform package. During the annual Davos meeting in January, when asked about whether Saudi Arabia has an alternative plan if the production-cut agreement falters or fails to bring in any results, Al-Falih responded that Saudi Arabia in that case can only be flexible, adaptable, and resilient.

Even more dangerous than the absence of a concrete plan is the erroneous self-perception that the kingdom is a swing producer that can dictate market behavior and major price trends. This is risky not only for Al-Falih, who is staking his own career on delivering higher prices, but also for the country as a whole. For foreseeable future, Saudi Arabia is highly dependent on the oil industry to support its entire economy, which is expected to grow at the meager rate of 0.4 percent in 2017, according to the International Monetary Fund (IMF). Saudi policymakers do not seem to realize that they do not and cannot control oil prices. Counter to what Al-Falih believes, the mechanism by which daily oil prices are set is far more complex than can be explained by production cuts, even by big players like Saudi Arabia. Only oil price reporting agencies such as Platts and the very few trading houses involved in their price discovery mechanisms get to determine the Brent and WTI benchmarks, and thus the daily global price of crude oil.

In a desperate measure to raise oil prices, El-Faleh and other OPEC members have tried to convince independent shale producers in the United States to cut oil production, to no avail. But Saudi Arabia and Aramco, its oil producing mammoth, are in no position to compete with the smaller and more agile U.S. shale producers. While Saudi Arabia enjoys low breakeven costs at the operating level, its public funding, fiscal commitments, and social stability depend on high fixed costs. Meanwhile, the shale-producing companies have managed to reduce their operating costs in the past three years, enabling them to profit at current low prices and to expand operations if prices rise. The independent shale producers have no public funding commitments, are enjoying historically low lending rates and significant outside investment, and their budgets are well hedged with investments in financial derivatives that stabilize the prices at which a particular company can sell.

Saudi Arabia is contemplating extending production cuts beyond the next OPEC meeting in May 2017 in a futile effort to raise oil prices. The main aim of the production-cut agreement is to reduce the global oil glut, in accordance with Al-Falih’s inaccurate belief that global oil inventories are declining. In fact, not only are crude oil inventories above historical averages, refined oil products inventories are swelling, adding more pressure on crude prices and refineries—another subsector Saudi Aramco is heavily invested in. The kingdom could lose even more income from dwindling market shares and the continuous pressure to discount export prices to fend off both regional and global competition. Riyadh would greatly benefit from a new, clear policy that is not blinded by short-term interests and includes at minimum more than a Plan B.

This article is reprinted with permission of Sada. It can be accessed online here.

Hadi Fathallah is a fellow at the Cornell Institute for Public Affairs and a member of the Global Shapers Community, an initiative of the World Economic Forum. On Twitter: @Hadi_FAO.

Subscribe to Our Newsletter